In America there are two taxpayer systems. Hopefully the following will help to explain the difference between the two tax systems:

- Type 1 taxpayer is an employee working for someone getting a regular paycheck, either monthly, bi-monthly, weekly or bi-weekly.

- Type 2 taxpayer is a person who owns their own home-based business.

Type 1 taxpayer is the employee

Employees, or W-2 wage earners, work for someone else.

Most taxpayers fall into this category.

They have very few tax deductions available to them, usually just

- Mortgage interest & Real Estate taxes,

- Standard deductions for dependents,

- Gifts to church or charity and

- Contributions to a retirement plan.

Essentially, for employees, it’s a three-step process:

- Work hard to earn a paycheck.

- Immediately lose a huge chunk of your paycheck to taxes.

- You get to live on what left called take-home-pay.

Type 2 tax payer is a Business Owner

This is no “Myth” about your options to leverage business expenses into tax deductions.

As a home-based business owner you get the same type tax deductions as large corporations. Home-based Business Owners have multiple tax deductions available to them.

As a home-based business owner you get the same type tax deductions as large corporations. Home-based Business Owners have multiple tax deductions available to them.- Computers, copiers, fax machines and telephones

- Advertising

- Paper, pens and postage

- Bank fees on business accounts

- Desks, sofas, coffee tables and other furniture

- Credit card annual fees (for business-only cards)

- Legal and professional services

- Phones bills, cell-phones, pagers and Personal Digital Assistants

- Supplies and materials

- Plane fares, hotel costs, meals and rental cars

- Taxes and licenses

- Security alarms and hidden cameras

- Health, life, dental, vision, disability and unemployment insurance

- And any other expense that qualifies as “ordinary and necessary” to operate their business.

- Internet access fees

- Web hosting fees

- Cable, DSL or Broadband internet service

- Computer extended-warranty costs

- Database backup services

- Ink and Toner cartridges for printers

- Software used for business

Business Owners have a very different three-step tax system:

- Earn revenue from selling goods or services,

- Spend whatever they need to on operating expenses to keep the business financially solid,

- Then pay taxes only on whatever is left over.

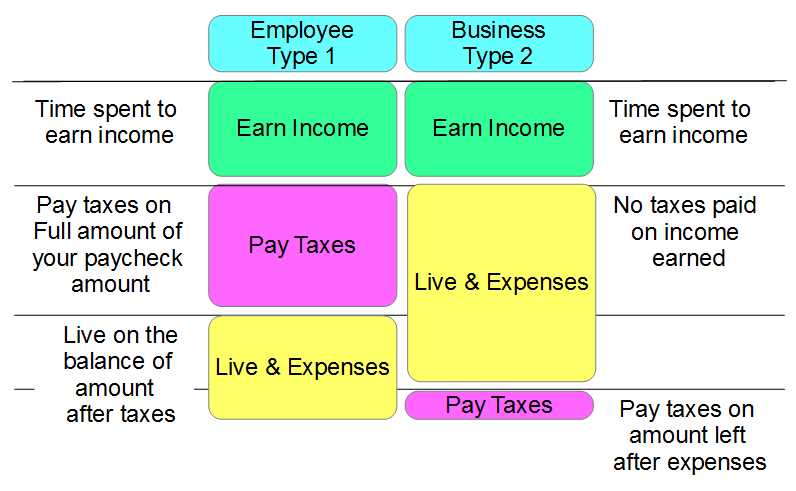

The diagram below shows a representation of the how the two tax systems work.

Notice the method and amount of taxes paid by a Type 1 tax payer compared to a Type 2 tax payer.

Notice the method and amount of taxes paid by a Type 1 tax payer compared to a Type 2 tax payer.

Also note, the taxes paid for an employee (Type 1) is paid immediately based on the amount of your wages earned. The taxes paid on the business (Type 2) is paid at the end of the year based on what is left over after paying all your business expenses.

The amount of taxes paid from an Type 2, business is much less based on the tax deductions from the business expenses. Learn more about how to use your Type 1 taxes for Type 2 deductions, the W-4 Program, to reduce or negate your annual income taxes.